BYD Shark 6 Disrupts Australia’s Ute Market

Key Takeaways

- The BYD Shark 6 has surged into Australia’s top 10 best-sellers by outperforming the Isuzu D-Max.

- The plug-in hybrid ute recorded a remarkable debut, buoyed by an administrative adjustment that boosted its February figures.

- The market is witnessing a mixed performance with traditional models declining, while new entries and emerging technologies drive growth.

- BYD’s ambitious local strategy hints at significant expansion in the coming months.

The automotive landscape in Australia is undergoing a notable transformation, and the latest disruption comes from the BYD Shark 6. This plug-in hybrid (PHEV) ute has not only captured consumer attention but has also managed to outpace established players like the Isuzu D-Max, making a striking entry as the sixth best-selling model in February 2025.

A Strong Debut Amidst Data Adjustments

In its inaugural month, the BYD Shark 6 delivered an impressive 2026 units to eager customers. However, a slight twist in the story comes from an administrative oversight: 450 units delivered in January were mistakenly omitted from that month’s VFACTS industry sales report. Once these figures were correctly allocated to February, the Shark 6’s sales surpassed those of the Isuzu D-Max, which has long been a consistent performer in the ute segment.

Shifting Trends in Ute Sales

The traditional powerhouse, the Isuzu D-Max, recorded 2022 deliveries in February, showing a significant decline of 31.2 per cent overall. This drop was seen across both 4×2 models (down by 18.1 per cent) and 4×4 variants (declining by 34.1 per cent). The broader ute segment was not immune to these changes, with overall light commercial vehicle deliveries falling by 10.2 per cent in the same period. Specifically, 4×2 ute deliveries dropped by 33 per cent, 4×4 utes by 7.9 per cent, and large pickups by 12.7 per cent.

Emerging Winners and Market Dynamics

While traditional models struggled, a few key players managed to buck the trend. For instance, the Mazda BT-50 saw a modest increase of 1.7 per cent, the Jeep Gladiator experienced a dramatic jump of 127.8 per cent (despite low absolute numbers), the Chevrolet Silverado 1500 climbed by 16.4 per cent, and the Toyota Tundra by 69.6 per cent. Additionally, JAC’s T9, a recent entrant, recorded 204 deliveries, signalling a shift towards innovative and diversified offerings in the market.

Strategic Advantages and Future Prospects

The success of the BYD Shark 6 isn’t merely a stroke of luck. It appears to have capitalised on the imminent end of the Fringe Benefits Tax (FBT) exemption for PHEVs, set to expire on 1 April 2025. This regulatory change, coupled with BYD’s unique position as Australia’s only PHEV ute at the moment, has provided a timely boost. Although competitors such as the Ford Ranger PHEV and GWM Cannon Alpha PHEV are on the horizon, the Shark 6 currently enjoys a significant first-mover advantage.

BYD’s Rising Market Presence

Beyond the individual model’s performance, BYD’s overall brand momentum is noteworthy. With the addition of new models like the Sealion 6 PHEV and Sealion 7 electric SUVs, BYD saw its total sales leap by 111.8 per cent compared to February 2024. This remarkable growth propelled BYD to become the 11th best-selling brand in Australia, achieving 3281 deliveries despite notable declines in other models such as the Atto 3, Dolphin, and Seal.

Ambitious Goals for the Future

Looking ahead, BYD’s local distributor, EVDirect, has set its sights high with an ambitious target to surpass Toyota by 2027—or at the very least, secure a top-three spot in the Australian market. With a goal of reaching 45,000 sales this year and plans to double its annual sales, the strategy is clear. EVDirect’s CEO, David Smitherman, has also confirmed plans to double the local retail network over the next 6 to 12 months, underscoring the brand’s commitment to expanding its footprint in Australia.

Final Thoughts

The entry of the BYD Shark 6 into the Australian market is a clear indicator of shifting consumer preferences and evolving market dynamics. As established players grapple with declining sales, innovative models backed by strategic regulatory timing are stepping up to meet new demands. For enthusiasts and industry watchers alike, this represents a fascinating moment of change—and one that is likely to shape the future of Australia’s automotive landscape.

Stay tuned to MRT for more insights and updates on the latest trends in the automotive world.

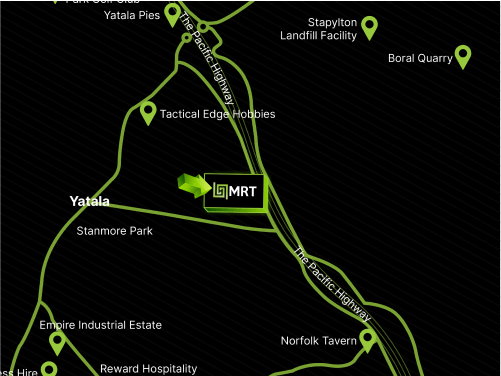

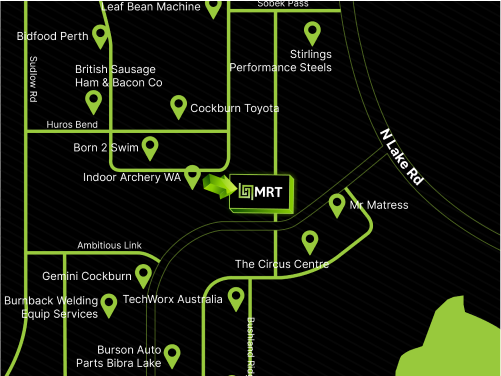

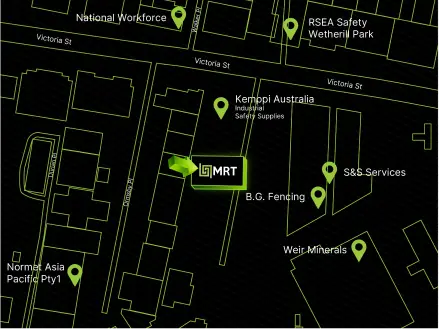

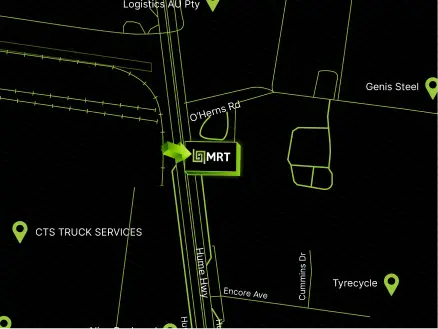

VIEW ON GOOGLE MAPS

VIEW ON GOOGLE MAPS

1300 650 090

1300 650 090